Payback period formula

When applying the payback period formula to a specific investment you can take the initial cost of the investment and divide it by the investments yearly cash flow. Divide the unrecovered amount by the cash flow amount in the recovery year ie.

Cac Payback Period Formula And Calculator

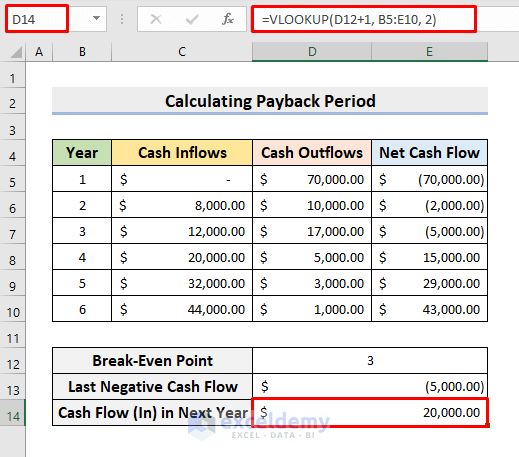

Input Data in Excel.

. By substituting the numbers into the formula you divide the cost of the investment 28120 by the annual net. 400000 72000 55 years This means you could recoup your. Payback Period 3000000.

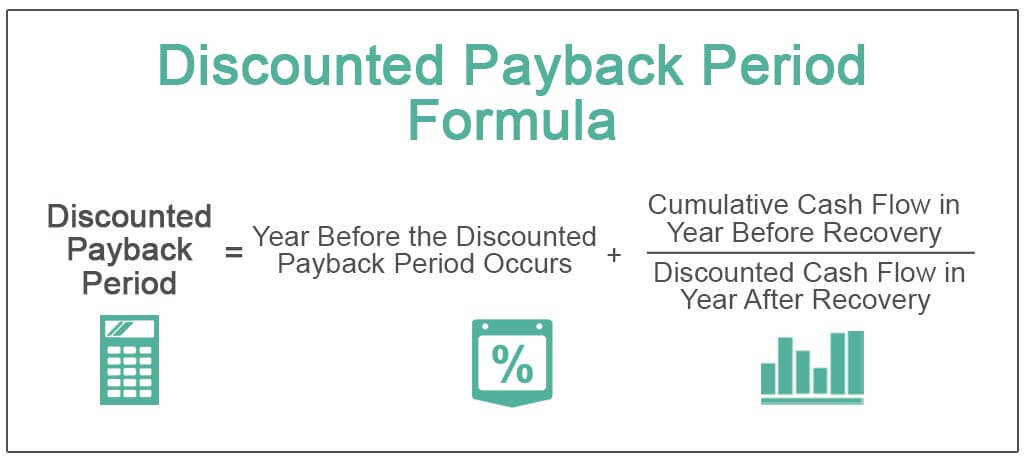

The payback period formula is used to determine the length of time it will take to recoup the initial amount invested on a project or investment. The cash produced in the period that the company begins to turn a profit on the project for the first time. Payback Period Full Years Until Recovery Unrecovered Cost at the Beginning of the Last YearCash Flow During the Last Year 5 500000500000 5 1 6 Years.

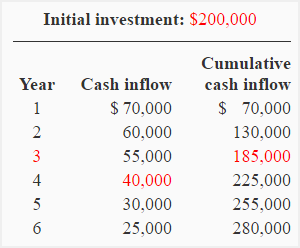

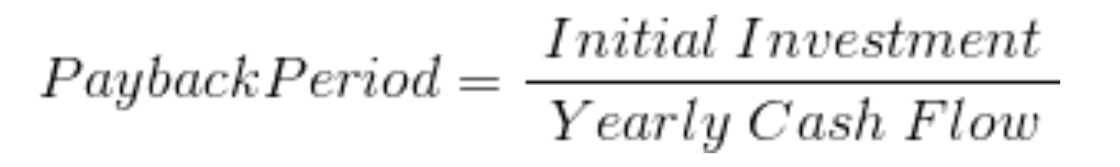

Divide the cash outlay which is assumed to occur entirely at the beginning of the project by the amount of net cash inflow. As you can see using this formula to calculate the payback period is relatively straightforward under. Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per.

The payback period for this investment is 7 and a half years - which we calculate by dividing 3 million with 400000 using the formula shown below. The formula for the payback method is simplistic. Your payback period will be 8 months.

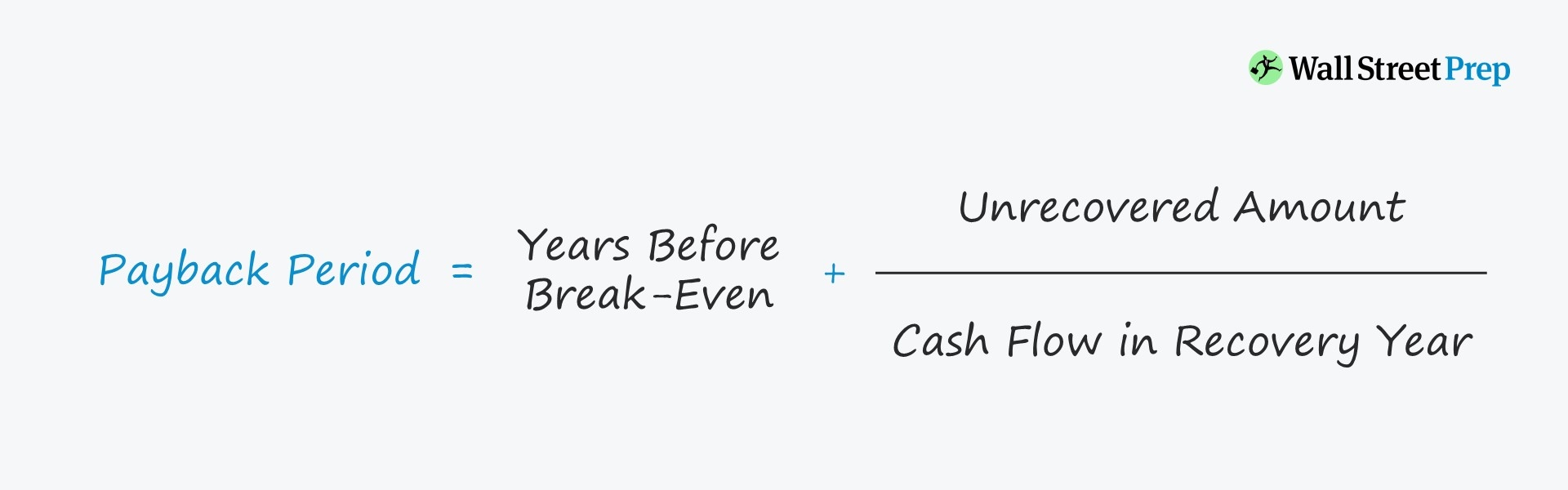

Calculate the payback period using the formula. Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years until the break-even point. Retrieve Last Negative Cash Flow.

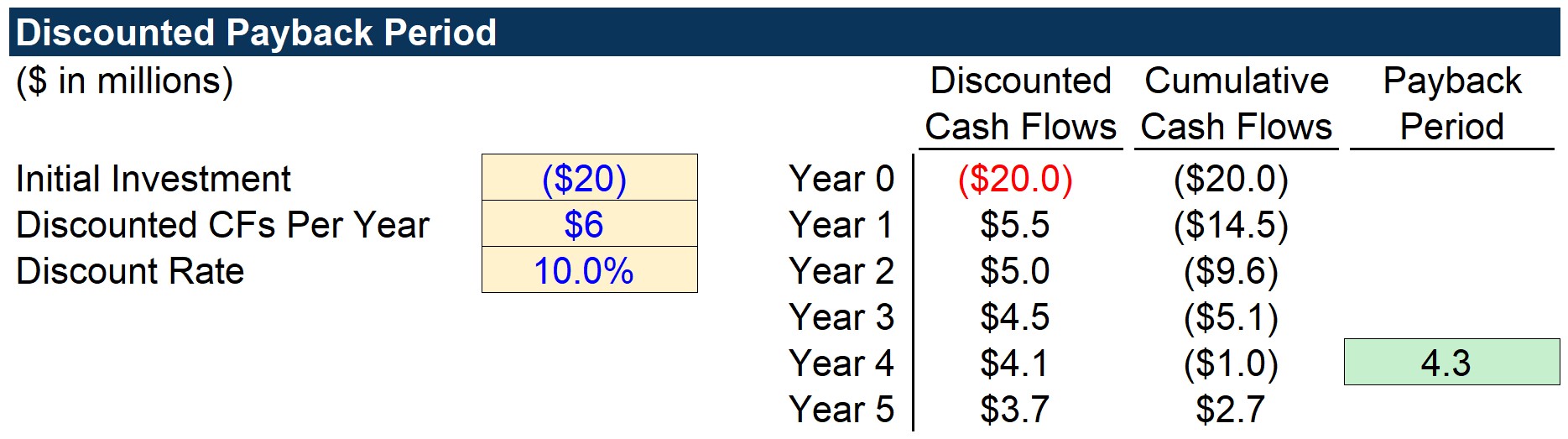

Find Cash Flow in Next Year. To calculate your payback period youll divide the cost of the asset 400000 by the yearly savings. 100 20 5 years Discounted.

The formula you will use to compute a PBP with even cash flows is. The payback period formula is used for quick. Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20.

Calculate Net Cash Flow.

How To Calculate Payback Period In Excel With Easy Steps

How To Calculate The Payback Period With Excel

Discounted Payback Period Meaning Formula How To Calculate

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

What Is Payback Period Formula Calculation Example

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info

How To Calculate The Payback Period With Excel

Calculation Of Pay Back Period Pbp Assignment Point

Payback Period Method Double Entry Bookkeeping

Payback Period Formula And Calculator

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Method Commercestudyguide

How To Use The Payback Period

Undiscounted Payback Period Discounted Payback Period

Undiscounted Payback Period Discounted Payback Period

Payback Period Formula And Calculator